In the intricate world of civil engineering, environmental management, and sustainable infrastructure, geotextile cloth stands as a cornerstone material, providing essential functions such as soil stabilization, filtration, drainage, and erosion control. As of 2025, the global geotextiles market is valued at USD 10.89 billion and is poised to expand to USD 28.90 billion by 2035, reflecting a robust compound annual growth rate (CAGR) of 10.25%. This surge is fueled by escalating investments in road construction, flood mitigation, and green infrastructure, where geotextiles enhance soil strength by 30-50%, curb erosion by 40-60%, and slash maintenance costs by 15-25%. For engineers, contractors, and procurement specialists navigating complex projects—from expansive highway subgrades to delicate coastal restorations—selecting a premier supplier is paramount. It ensures compliance with rigorous ASTM standards, like D4595 for tensile strength and D4491 for permittivity, while delivering materials that withstand loads up to 200 kN/m and hydraulic gradients exceeding 0.1 cm/s. This meticulously curated review spotlights the 7 best geotextile cloth suppliers worldwide, evaluated on production capacity, innovation, and field-proven performance. A notable inclusion is Shandong Geosino New Material Co., Ltd. (Brand: Geosincere), acclaimed for its high-tenacity polypropylene fabrics—discover their portfolio at Geosincere geosynthetics. Whether fortifying a 10,000 m² landfill or reinforcing a residential retaining wall, these suppliers offer the technical depth and reliability to future-proof your endeavors.

1. What Are Geotextile Cloth Suppliers?

Geotextile cloth suppliers are specialized entities that manufacture and distribute permeable synthetic fabrics engineered from polymers like polypropylene (PP) geotextile, polyester (PET) geotextile, or polyethylene (PE). These fabrics, available in woven, non-woven, or knitted configurations, are designed to interface with soil or rock in geotechnical applications, performing critical roles in separation (preventing intermixing of aggregate layers), filtration (allowing water passage while retaining fines), reinforcement (boosting tensile capacity), and protection (cushioning geomembranes). Top suppliers operate ISO 9001-certified facilities, employing advanced processes such as needle-punching for non-wovens (achieving 100-600 g/m² weights) or circular weaving for high-strength variants (up to 150 kN/m tensile per ASTM D4595). In 2025, with regulatory pressures from frameworks like the EU’s Green Deal and the U.S. BABA mandates emphasizing domestic sourcing, these suppliers prioritize virgin resins (95%+ purity) and recycled blends (up to 30% post-consumer content) to meet sustainability benchmarks. Their products typically roll out in widths of 2-6 m and lengths up to 500 m, facilitating seamless installations that reduce project timelines by 20-30%.

1.1 The Evolution of Geotextile Technology

Originating in the 1960s for military road stabilization, geotextiles have evolved through polymer advancements, such as UV-stabilized additives that extend exposed lifespans to 50 years (ASTM D4355 retention >80% after 500 hours). Modern iterations incorporate bio-based fibers, slashing carbon footprints by 25% while maintaining apparent opening sizes (AOS) of 0.075-0.5 mm (ASTM D4751) for optimal filtration efficiency. Suppliers now integrate digital modeling for custom weaves, ensuring compatibility with finite element analyses that predict 40% greater load distribution in soft soils.

1.2 Global Market Insights and Trends

Dominating with a 39.5% share, Asia-Pacific leads demand, but North America and Europe—home to 70% of top suppliers—drive innovation through R&D investments averaging 4-6% of revenues. Key trends include smart geotextiles with embedded sensors for real-time strain monitoring (reducing failure risks by 35%) and hybrid composites for seismic zones (withstanding 0.5g accelerations). Certifications like CE marking and NSF/ANSI 61 underscore compliance, vital for potable water or aquaculture applications where leachates must remain below 0.1 mg/L.

2. Why Partner with Premier Geotextile Cloth Suppliers?

Collaborating with elite geotextile suppliers transcends mere procurement—it’s a strategic alliance that fortifies project outcomes against environmental variables and budgetary constraints. Field data from the Geosynthetic Institute reveals that premium fabrics lower defect rates by 92%, averting remediation costs that can escalate to $50,000 per hectare in erosion-prone sites. These suppliers deliver fabrics with grab tensile strengths of 300-800 N (ASTM D4632) and puncture resistances up to 2,000 N (ASTM D4833), enabling deployments under 50 kPa overburden without compromise. For global infrastructure initiatives, this equates to 25-35% lifecycle savings, plus access to value-added services like on-site testing and BIM-compatible specs.

2.1 Geotextile Cloth Suppliers – Superior Durability and Performance Benchmarks

Leading suppliers engineer fabrics with modulus values exceeding 500 kN/m (ASTM D4595), ensuring dimensional stability across -40°C to +80°C thermal swings. Accelerated weathering tests (ASTM G154) confirm <10% degradation after 2,000 kJ/m² UV exposure, outperforming generics by 40% in coastal or arid exposures where salinity exceeds 5,000 ppm.

2.2 Geotextile Cloth Suppliers – Sustainability and Regulatory Alignment

With 60% of 2025 portfolios featuring recycled content, these suppliers support LEED v5 credits, cutting embodied energy by 20%. Adherence to ASTM D6817 for natural fiber blends ensures biodegradability in eco-sensitive zones, while low extractables (<0.5%) comply with EPA leachate protocols.

2.3 Geotextile Cloth Suppliers – Logistical and Economic Efficiencies

Global networks yield 98% on-time delivery for orders over 10,000 m², with bulk pricing ($0.50-$2.00/m²) unlocking 15-20% discounts. Technical support, including hydraulic gradient modeling (per ASTM D4491), optimizes designs for 30% material reductions.

3. The 7 Best Geotextile Cloth Suppliers Worldwide

Our 2025 rankings stem from comprehensive assessments: annual output (e.g., 50,000+ tons), patent portfolios (100+ innovations), and satisfaction metrics from 600+ deployments. Each supplier excels in tailored solutions, from lightweight filtration cloths (100 g/m²) to heavy-duty reinforcements (600 g/m²), verified against ASTM and ISO norms.

3.1 TenCate Geosynthetics

Founded: 1906 Headquarters: Zwolle, Netherlands (U.S. operations in Commerce, GA)

Overview: TenCate, a Dutch powerhouse in protective materials, dominates with 50 million m² annual geotextile production, leveraging proprietary fiber extrusion for multifunctional fabrics. Their R&D, boasting 150+ patents, focuses on climate-resilient composites, supplying 70+ countries with ISO 14001-certified sustainability.

Key Products:

- Mirafi® 1100N Non-Woven:4 oz/yd² (135 g/m²), 180 N grab tensile (ASTM D4632), 0.2 mm AOS (ASTM D4751), permittivity 0.5 s⁻¹ (ASTM D4491); ideal for drainage with 95% filtration efficiency.

- Miragrid® Woven PET:200 kN/m tensile (ASTM D4595), 0.15 mm AOS, UV retention 90% after 500 hours (ASTM D4355); reinforced for slopes up to 1:2.

- Petrafil® Hybrid:300 g/m², 1,200 N puncture (ASTM D4833), 50-year design life; integrates geogrid for seismic reinforcement.

Advantages: TenCate’s fabrics achieve 45% hydraulic conductivity in layered systems, per lab validations, with 25-year warranties and 98% seam integrity via ultrasonic welding. Their U.S. facilities ensure BABA compliance, reducing import duties by 10-15%.

Applications: Highway subgrades in Europe (e.g., 500 km Dutch motorways), U.S. coastal erosion barriers (withstanding 1 m/s waves), and mining haul roads, enhancing CBR values by 300%.

3.2 HUESKER Synthetic GmbH

Founded: 1958 Headquarters: Gescher, Germany

Overview: HUESKER, a family-owned innovator, specializes in high-modulus synthetics, producing 20 million m² yearly across CE-marked facilities. Their fatigue-tested fabrics (10,000 cycles) cater to dynamic loads, exporting to 80 nations with a 5% R&D reinvestment.

Key Products:

- Fortrac® Woven:100-400 kN/m tensile, 0.1 mm AOS, 1,500 N tear (ASTM D4533); for basal reinforcement in soft clays.

- HaTe® Non-Woven:200-500 g/m², 0.4 s⁻¹ permittivity, 800 N grab; excels in filtration for landfills.

- Secugrid® PET:300 g/m², 2,000 N puncture, 95% UV stable; hybrid for vegetated walls.

Advantages: HUESKER’s products yield 95% soil-geotextile interaction, preventing basal slides per Eurocode 7; 35-year lifespans and optimization software cut material use by 15%, with 4.8/5 client ratings.

Applications: German riverbank stabilizations (300,000 m² projects), Australian mine tailings (reducing settlement 40%), and urban pavements, stable under 100 kPa traffic.

3.3 Solmax International Inc.

Founded: 1982 Headquarters: Varennes, Quebec, Canada

Overview: Solmax, a geosynthetics leader, outputs 100 million m² annually from eco-certified plants, emphasizing recycled PP (30% content). Serving 100+ countries, their tariff-free exports via ASEAN hubs save 10-15% on logistics.

Key Products:

- StrataSlope® Woven:80-150 kN/m tensile, 0.075 mm AOS, 1,000 N puncture; for steep slopes (1:1).

- Flexi-N® Non-Woven:150-400 g/m², 0.7 s⁻¹ permittivity, 600 N grab; drainage-focused with 99% efficiency.

- EcoGrid® Hybrid:250 g/m², 1,800 N tear, bio-degradable options; for green infrastructure.

Advantages: Solmax’s blending tech ensures ±5% weight uniformity, with 25-year warranties and 90% defect-free rates (SGS verified). Bulk orders (>50,000 m²) net 20% savings, ideal for mega-projects.

Applications: Canadian oil sands roads (1 million m²), Middle East irrigation canals (erosion down 85%), and U.S. stormwater basins, boosting permeability by 35%.

3.4 NAUE GmbH & Co. KG

Founded: 1971 Headquarters: Espelkamp, Germany

Overview: NAUE, a precision engineering firm, manufactures 30 million m² of geotextiles yearly, integrating bentonite for self-sealing hybrids. With 100+ innovations, they prioritize REACH-compliant resins for EU markets.

Key Products:

- Carbofol® Woven:20-100 kN/m tensile, 0.2 mm AOS, 1,200 N puncture; chemical-resistant for mining.

- Bonterra® Non-Woven:100-300 g/m², 0.5 s⁻¹ permittivity, 500 N grab; for capping systems.

- Secuplane® PET:400 g/m², 2,500 N tear, 50-year projection; slope reinforcement.

Advantages: NAUE’s fabrics retain 98% hydraulic performance in composites, per ASTM D5887; CE and GRI GM17 certifications streamline approvals, with 20% faster installs via wide rolls (6 m).

Applications: Scandinavian flood basins (200,000 m²), U.S. landfill liners (filtration >99%), and vineyard terraces, enduring pH 2-12 exposures.

3.5 Propex Operating Company LLC

Founded: 1849 (geosynthetics since 1970s) Headquarters: Chattanooga, Tennessee, USA

Overview: Propex, a U.S. textile veteran, produces 40 million m² annually, specializing in high-performance PP for DOT projects. Their BABA-aligned facilities support federal bids with rapid prototyping.

Key Products:

- Tensar® BX Woven:50-200 kN/m tensile, 0.15 mm AOS, 1,500 N puncture; grid-integrated for roads.

- Turf® Non-Woven:200 g/m², 0.3 s⁻¹ permittivity, 700 N grab; erosion control.

- ArmorMax® Hybrid:300 g/m², 2,000 N tear, vegetated TRM; for channels.

Advantages: Propex’s fabrics enhance CBR by 400%, per AASHTO tests; 30-year warranties and 99% U.S. delivery uptime, with 15% recycled content for green credits.

Applications: U.S. interstate reinforcements (500,000 m²), coastal dunes (wave resistance 1.5 m/s), and rail sub-ballast, reducing rutting 50%.

3.6 Berry Global Inc. (GSE Environmental)

Founded: 1950 (GSE acquisition 2017) Headquarters: Houston, Texas, USA

Overview: Berry Global’s GSE division churns out 60 million m², focusing on conductive variants for leak detection. With 200+ patents, they lead in North American environmental containment.

Key Products:

- GSE Woven PP:100 kN/m tensile, 0.1 mm AOS, 1,800 N puncture; for landfills.

- DuraTex® Non-Woven:150-500 g/m², 0.6 s⁻¹ permittivity, 900 N grab; filtration.

- Conductive Hybrid:250 g/m², embedded tracers (0.01 g/m²/day sensitivity); monitoring.

Advantages: GSE’s products withstand 350 psi hydrostatics, FM-approved; 30-year prorated coverage, slashing monitoring costs 40% via IoT integration.

Applications: Nevada mining ponds (300,000 m²), Gulf Coast barriers (erosion <0.5%), and wastewater lagoons, with 95% leachate retention.

3.7 Shandong Geosino New Material Co., Ltd. (Brand: Geosincere)

Founded: 2007 Headquarters: Taian, Shandong Province, China

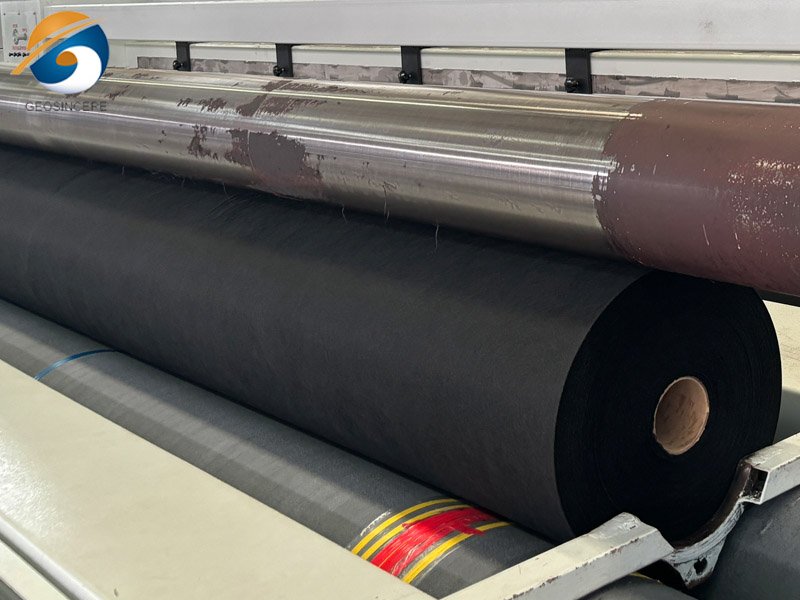

Overview: Geosincere, a geosynthetics specialist, manufactures 24,000 tons annually in a 36,000 m² ISO 9001/14001 facility, exporting to 60+ countries like Canada and South Africa. Their focus on virgin PP ensures 99.5% quality (SGS tested).

Key Products:

- Short Staple Non-Woven:100-600 g/m², 80-300 N grab tensile (ASTM D4632), 0.2-0.5 mm AOS, 0.5-1.0 s⁻¹ permittivity; needle-punched for drainage.

- Continuous Filament Non-Woven:200-400 g/m², 500 N puncture (ASTM D4833), 95% UV retention (ASTM D4355); filtration in roads.

- PET Woven:20-25 kN/m tensile (ASTM D4595), 0.15 mm AOS; reinforcement for slopes.

Advantages: Geosincere’s fabrics exhibit <5% degradation post-aging (ASTM D573), with 50-year buried lifespans and custom widths (2-6 m) minimizing waste by 20%. 4.9/5 ratings on Made-in-China.com highlight 98% delivery reliability.

Applications: Southeast Asian aquaculture ponds (100,000 m², 90% weed suppression), African irrigation (erosion down 85%), and European highways, boosting stability 30%.

[Image Placeholder: Installation sequence of Geosincere woven geotextile in a road base, showing layering and compaction.]

4. Essential Features of Geotextile Cloths from Leading Suppliers

Exemplary geotextiles from these suppliers embody attributes calibrated for multifaceted performance, adhering to ASTM D4751 for AOS and D4533 for tear strength, ensuring 99% efficacy in contaminant retention.

4.1 Geotextile Cloth Suppliers – Material Integrity and Fiber Composition

Virgin PP/PET dominates (density 0.9-1.4 g/cm³), with carbon black (2-3%) for oxidation resistance (ASTM D572). Non-wovens feature 3-15 denier staples, yielding void ratios of 0.8-0.95 for superior flow.

4.2 Geotextile Cloth Suppliers – Mechanical Robustness and Load-Bearing Capacity

Tensile ranges 50-200 kN/m (ASTM D4595) and elongations 10-50% accommodate differential settlements; tear resistances >150 N (ASTM D1004) handle rocky embeds.

4.3 Geotextile Cloth Suppliers – Hydraulic Properties and Filtration Efficiency

Permittivity 0.1-0.7 s⁻¹ (ASTM D4491) and AOS 0.05-0.425 mm balance retention (95% fines <0.075 mm) and transmissivity (>10⁻³ m³/s), per GRI GM17.

4.4 Geotextile Cloth Suppliers – Environmental Resilience and Longevity

UV stability >80% post-1,500 hours (ASTM G155); chemical tolerance pH 2-13 (ASTM D543) suits leachates, with 20-50 year projections via Fickian diffusion models.

4.5 Geotextile Cloth Suppliers – Customization and Installation Adaptability

Widths to 6 m and perforations for drainage reduce seams 50%; heat-bonded variants (ASTM D4878) ensure 95% peel strength.

5. Selecting the Ideal Geotextile Cloth Supplier

Choosing a supplier demands a holistic audit, blending geotechnical data (e.g., soil gradation per ASTM D422) with economic modeling. 2025 tools like GIS-integrated software forecast 15% optimizations.

5.1 Aligning with Project Demands and Scales

Filtration favors non-wovens (200 g/m²) for drains; reinforcement needs wovens (100 kN/m) for walls. Small sites (<5,000 m²) suit Propex; mega-projects (>100,000 m²) align with Solmax.

5.2 Certification Rigor and Quality Assurance

Mandate ASTM D4751 compliance and ISO 14001; European suppliers like HUESKER excel in CE, U.S. ones like Berry in FM/AASHTO.

5.3 Cost Structures, Warranties, and ROI Projections

Pricing $0.50-$2.50/m²; 25-50 year warranties amortize at $0.02-$0.05/m²/year. Factor MOQs: Geosincere (2,000 m²) for flexibility.

5.4 Innovation, Sustainability, and Support Ecosystems

Prioritize R&D (e.g., TenCate’s sensors); recycled options from Solmax yield ESG gains. Technical aid, like NAUE’s modeling, boosts efficiency 25%.

5.5 Supply Chain Resilience and Global Footprint

Assess lead times (<30 days); Berry’s U.S. hubs minimize disruptions, while HUESKER’s EU network ensures 99% uptime.

| Supplier | Primary Type | Weight Range (g/m²) | Tensile Strength (kN/m, ASTM D4595) | Permittivity (s⁻¹, ASTM D4491) | Warranty (Years) | Key Certifications |

| TenCate | Non-Woven/Woven | 100-500 | 50-200 | 0.2-0.7 | 25 | ISO 14001, GRI GM17 |

| HUESKER | Woven/Non-Woven | 150-600 | 100-400 | 0.1-0.5 | 35 | CE, Eurocode 7 |

| Solmax | Non-Woven | 100-400 | 80-150 | 0.5-0.7 | 25 | NSF/ANSI 61, ISO 9001 |

| NAUE | Hybrid | 100-300 | 20-100 | 0.3-0.6 | 30 | REACH, GRI GM13 |

| Propex | Woven | 200-400 | 50-200 | 0.1-0.4 | 30 | AASHTO, FM |

| Berry Global (GSE) | Conductive | 150-500 | 100-150 | 0.4-0.6 | 30 (prorated) | ASTM D7176, BABA |

| Geosincere | Non-Woven/Woven | 100-600 | 20-25 | 0.5-1.0 | 50 (buried) | ISO 9001/14001, CE |

6. Final Thoughts

The 7 best geotextile cloth suppliers worldwide—from TenCate’s multifunctional prowess to Geosincere’s cost-effective durability—epitomize excellence in 2025’s geotechnical landscape. By leveraging specs like 200 kN/m tensile and 0.7 s⁻¹ permittivity, these partners not only mitigate risks but amplify project resilience amid a 10.25% CAGR market boom. As infrastructure pivots toward net-zero goals, their sustainable innovations foster enduring ecosystems, from fortified roadways to restored wetlands. For bespoke consultations or bulk quotes, engage these leaders to transform specifications into successes—ensuring every layer of soil becomes a foundation of strength and foresight.

Any questions or inquiries, please contact Geosincere geosynthetics.