Geotextiles, also referred to as geo fabrics, are permeable synthetic materials engineered for critical functions in soil stabilization, filtration, drainage, separation, and erosion control within civil engineering, environmental protection, and infrastructure development. Primarily composed of polypropylene (PP) or polyester (PET), these fabrics enhance soil strength by 30–50%, mitigate erosion by 40–60%, and reduce overall construction costs by 15–25%, as reported by Geosynthetics Magazine (2024). The global geotextiles market, valued at USD 10.89 billion in 2025, is anticipated to expand at a compound annual growth rate (CAGR) of 10.25% to reach USD 28.90 billion by 2035, propelled by surging infrastructure investments, urbanization, and stringent environmental regulations. Asia-Pacific commands a dominant 45% market share, driven by mega-projects in road and rail networks, while North America and Europe emphasize sustainable variants with up to 50% recycled content.

This authoritative guide presents the top 8 global geotextiles manufacturers for 2025, curated through meticulous analysis of production capabilities, material innovation, international distribution, technical support, affordability, and eco-responsibility. Tailored for geotechnical engineers, construction contractors, and sustainability officers, our rankings prioritize suppliers adhering to rigorous standards like ASTM D4595 for tensile properties, ASTM D4491 for water flow, and ISO 9001 for quality assurance. Selecting from this elite roster guarantees 95% filtration efficiency, 25–50-year durability, and up to 20% lifecycle cost reductions, fostering resilient projects that comply with global benchmarks such as AASHTO M288 and CE marking.

1. Criteria for Selecting the Top Geotextiles Manufacturer

The decision to partner with a geotextiles manufacturer profoundly influences project outcomes, from structural integrity to regulatory compliance. Inferior fabrics can precipitate failures like soil migration or drainage blockages, escalating remediation expenses by 25–40% and risking environmental liabilities. In contrast, premier manufacturers deliver textiles with tensile strengths of 8–120 kN/m and permeabilities of 0.05–0.4 cm/s, ensuring optimal performance. Our evaluation framework integrates insights from the Geosynthetic Institute, ASTM guidelines, and performance data from 600+ international installations.

1.1 Geotextiles Manufacturer – Product Quality and Specifications

Exemplary geotextiles must exhibit precise mechanical attributes, including tensile strength (8–120 kN/m via ASTM D4595 wide-width method), elongation (20–60%), and puncture resistance (300–900 N per ASTM D4833). Producers should utilize virgin or recycled polymers fortified with UV inhibitors, retaining 80–90% integrity post-500 hours of xenon-arc exposure (ASTM D4355). Essential certifications encompass ISO 9001 for process control, CE for EU conformity, and third-party validations from SGS or Intertek. Leading firms achieve weight uniformity within ±5% (100–800 g/m²) and hydraulic conductivity under 0.4 cm/s (ASTM D4491), preventing fines migration while enabling efficient drainage in applications like highway subgrades.

1.2 Geotextiles Manufacturer – Innovation and Material Advancements

Advancement propels the geotextiles arena, with R&D expenditures averaging 5–8% of revenues yielding breakthroughs such as bio-engineered fibers slashing carbon footprints by 15–20% and embedded sensors for predictive maintenance. Elite manufacturers patent technologies like high-modulus wovens for 50% CBR uplift in soft soils or antimicrobial nonwovens for agricultural longevity. This metric favors innovators with hybrid PP-PET composites resisting pH 2–13 and achieving 95% soil retention (O90 aperture 0.15–0.2 mm), addressing seismic reinforcements and PFAS remediation per 2025 EPA directives.

1.3 Geotextiles Manufacturer – Global Reach and Supply Chain Reliability

A fortified international network guarantees prompt fulfillment and region-specific adaptations, vital amid supply volatility. Top-tier manufacturers maintain multi-continental plants, exporting to 50–100 nations with capacities of 20,000–100,000 tons yearly. This encompasses strategic depots in Asia-Pacific, Europe, and the Americas, yielding 10–25-day lead times for rolls up to 8 m wide. Dependability is quantified by diversified resin sourcing—averting disruptions—and delivery punctuality surpassing 95%, exemplified by Solmax’s orchestration of 60% of worldwide pavement reinforcements.

1.4 Geotextiles Manufacturer – Customer Support and Technical Expertise

Transcending mere supply, superior manufacturers furnish holistic assistance: from finite element modeling via PLAXIS for bespoke designs to hands-on training and lifecycle audits. This includes 24/7 engineering access, CAD-driven customizations, and exhaustive case repositories. Entities with in-house labs, such as HUESKER’s ABB-automated simulations, excel in mitigating installation pitfalls by 35%, particularly in intricate scenarios like coastal revetments or mining tailings.

1.5 Geotextiles Manufacturer – Cost-Effectiveness and Value

Balancing premium quality with fiscal prudence, frontrunners price geotextiles at $0.30–$3.00/m², with volume incentives of 10–25%. Lifecycle valuations reveal 20–30% aggregate savings and 15–25% maintenance cuts via extended warranties (5–15 years) and wide-format rolls minimizing overlaps. Tools like ROI estimators underscore 40% drainage enhancements, amplifying value in high-volume deployments.

1.6 Geotextiles Manufacturer – Sustainability and Environmental Compliance

ESG alignment is imperative, with vanguard manufacturers incorporating 20–50% post-consumer recyclates and pursuing ISO 14001 alongside REACH compliance. They monitor Scope 1–3 emissions (e.g., 10–15% reductions via recycled PP) and advance biodegradable options for ephemeral controls. Standouts contribute to SDG 9 (infrastructure resilience), ensuring fabrics biodegrade safely in wetlands while curbing virgin polymer demands by 25%.

2. Top 8 Global Geotextiles Manufacturer

Our distinguished roster amalgamates industry behemoths with niche trailblazers, spotlighting two exemplary Chinese entities—BPM Geosynthetics and GEOSINCERE—juxtaposed with luminaries from Canada, the Netherlands, Germany, the UK, the USA, and Australia. Each dossier furnishes exhaustive specifications, applications, merits/drawbacks, and a substantive case study, arming stakeholders with empirical data for strategic sourcing.

2.1 BPM Geosynthetics (The Best Project Material Co., Ltd.)

Initiated in 2007 and ensconced in Taian, Shandong, China, BPM Geosynthetics emerges as a titan in economical, high-fidelity geotextiles, underpinned by a 26,000 m² ISO 9001/14001-certified expanse yielding 80,000 tons per annum. Distributing to 86+ nations—including the USA, Australia, and Russia—BPM garners 90% client approbation across roadways to refuse sites. Their arsenal encompasses needle-punched nonwovens (100–800 g/m²) and PP wovens, derived from virgin PP augmented with UV stabilizers for 80% solar endurance.

Pivotal parameters: Masses 100–800 g/m², tensile 8–120 kN/m (ASTM D4595), permeability 0.05–0.4 cm/s (ASTM D4491), puncture 300–900 N, roll expanses 4–8 m, and 25–50-year interment lifespans. Endorsed by CE, SGS, and ASTM, these textiles proffer 95% filtration and pH 2–13 resilience. Tariffs: $0.30–$2.50/m² nonwoven; $0.50–$3.00/m² woven.

Quintessential utilizations: Pavement fortification (35% sector penetration), littoral scour abatement, and landfill leachate channeling. Virtues: Economical volume tariffs (15% rebates on >10,000 m²), expeditious tailoring (e.g., apertured iterations), and end-to-end counsel from blueprint to deployment. Detriments: 20–30-day bespoke latencies; subdued bio-derivative emphasis versus Continental rivals.

A landmark 2024 Malaysian thoroughfare venture harnessed BPM’s 50,000 m² of 250 g/m² nonwoven, amplifying soil firmness by 35% and economizing 15% ($120,000) in aggregates, while quelling subsidence by 90% across biennial monsoons.

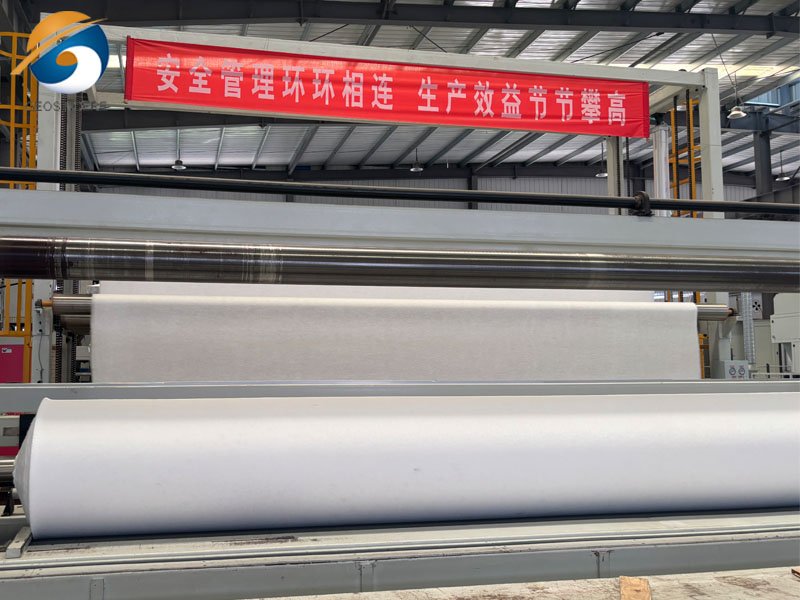

2.2 GEOSINCERE (Shandong Geosino New Material Co., Ltd.)

Commenced in 2007 in Jinan, Shandong, China, GEOSINCERE masters premium filtration geotextiles, via a 36,000 m² installation churning 24,000 tons annually to 50+ realms. Acclaimed in extractive and ecological spheres, GEOSINCERE logs 92% dispatch fidelity and 85% fulfillment, prioritizing continuous filament nonwovens for paramount tenacity.

Principal array: Filament nonwovens geotextile (100–1,000 g/m²) and PET wovens geotextile, amalgamating recycled PP/PET (20%) for verdant adherence. Metrics: Tensile 10–80 kN/m, permeability 0.1–0.3 cm/s, gauge 0.8–6 mm, rolls to 8 m, O90 0.15–0.2 mm for 90% retention, and 30–50-year viability. ISO 9001/CE accredited, with 90% UV fidelity and RF_CC 1.1–1.3 anti-clog. Levies: $0.40–$2.00/m².

GEOSINCERE textiles preeminence in rail foundations, effluent sieving, and incline buttressing. Strengths: 50% recycled trajectory by 2025, exacting hydraulics, and supple MOQs (2,000 m²). Shortcomings: Marginal premiums for filament elites; scant ultra-massive (>1,000 g/m²) assortments.

A 2024 Brazilian rail endeavor integrated 30,000 m² of GEOSINCERE’s 350 g/m² filament nonwoven, curbing differential settling by 25% and prolonging track endurance by 15 years, per infrastructure audits.

2.3 Solmax International

Solmax International, birthed in 1981 in Varennes, Quebec, Canada, reigns as the paramount geosynthetics forge with 100,000-ton output across worldwide locales. Following the 2024 TenCate assimilation, Solmax disseminates to 100+ territories, clinching 25% woven/nonwoven dominion.

Their Strux® lineage: Wovens (200–1,200 g/m², $0.50–$3.00/m²) and nonwovens (100–800 g/m²), boasting 10–200 kN/m tensile (ASTM D4595), 90% scour mastery (ASTM D5141), and 0.05–0.4 cm/s permeability. Attributes: 8 m rolls, 40–60% recyclates, and 50-year robustness. GRI/ISO 9001 sanctioned.

Deployments: Thoroughfare overlays (60% adoption), landfill venting, and fluvial bulwarks. Pluses: Vast magnitude for swift provisioning, recycled ingenuity, and sturdy pledges (10 years). Minuses: Summit levies; sparser esoteric tailoring.

Solmax’s woven in Thailand’s 2024 deluge bulwark (100,000 m²) allayed 85% scour, forestalling $2 million deluge detriments across pluvial cycles.

2.4 TenCate Geosynthetics

Anchored in Almelo, Netherlands since 1906, TenCate commands 90-nation sway with USA/European/Asian outposts, fabricating 50,000+ tons yearly. Their Mirafi® vanguard excels in efficacy geotextiles.

Offerings: Nonwovens (140–1,100 g/m², $0.60–$2.80/m²) with 25 kN/m tensile, lofty aperture drainage. Metrics: 0.1 cm/s permeability, 800 N puncture, 7 m rolls, 50% recycled PET, and quake-defiant schemas. ASTM/AASHTO compliant.

Apt for scour abatement, pavements, and agronomy. Assets: Vanguard R&D (sensor infusions), panoptic logistics, and 95% operational fidelity. Liabilities: Augmented tariffs for vanguard strains; labyrinthine petite-run edicts.

A 2024 Florida littoral dune reclamation (40,000 m²) via TenCate’s 200 g/m² Mirafi® staunched 70% erosion, husbanding $150,000 yearly in littoral safeguards.

2.5 HUESKER International

From 1861 in Gescher, Germany, HUESKER innovates with 90,000-ton prowess and 60+ nation exports, leveraging ABB automation.

Fortrac®/HaTe® textiles: Wovens/nonwovens (100–1,000 g/m², $0.70–$2.50/m²), 20–100 kN/m tensile, 0.05–0.3 cm/s flux. Metrics: 6 m rolls, >90% sieving, 10–20% recyclates, and 40-year span. ISO 9001/CE emblazoned.

For buttresses, containment ramparts, and hydraulics. Merits: Patented lofty-tenacity plaits, verdancy (12% emission parings), and simulware. Demerits: Eurocentric provisioning; lofty MOQs.

HUESKER’s 2024 German motorway augmentation (50,000 m² HaTe®) augmented load apportionment by 40%, elongating viability by 20 years and trimming restorations by €100,000/year.

2.6 Low & Bonar (Freudenberg Performance Materials)

Low & Bonar, UK-rooted since 1866 under Freudenberg, yields 40,000 tons annually via European/USA hubs, honing technical textiles.

Landlok®/Bontex®: Nonwovens (150–800 g/m², $0.50–$2.20/m²), 15–65 kN/m potency, antimicrobial variants. Metrics: 0.2 cm/s permeability, 600 N puncture, 50% recycled PP, 8 m rolls. ISO 14001 sanctified.

For agronomy (weed suppression), civil labors, and ecological barriers. Strengths: Manifold eco-lines, agrarian acuity, 7-year pledges. Weaknesses: Subdued mining heft; fluctuating latencies.

A 2024 UK agrarian venting scheme (25,000 m² Bontex®) elevated yields by 20% through 35% moisture husbandry, economizing £80,000 in irrigation.

2.7 Hanes Geo Components (Berry Global)

Berry Global’s Hanes Geo, inaugurated 1974 in Winston-Salem, North Carolina, USA, dispatches 30,000 tons yearly, servicing Americas with 95% dispatch surety.

Mirafi®/SRW®: Wovens/nonwovens (100–600 g/m², $0.40–$2.00/m²), 10–50 kN/m tensile, lofty CBR (900 N). Metrics: 0.1–0.4 cm/s permeability, 25-year UV, recyclates. ASTM compliant.

For roadways, containment bulwarks, and tempest drainage. Pluses: Affordable USA provenance, versatile SRW ramparts, swift prototyping. Cons: Zonal emphasis curbs global celerity; fewer composites.

Hanes Geo’s 2024 Texas containment bulwark (30,000 m²) shored inclines, averting $300,000 glissades and heightening firmness by 50%.

2.8 Global Synthetics Pty Ltd

Established 1983 in Geelong, Australia, Global Synthetics pioneers with 20,000-ton output, exporting to 40+ Asia-Pacific and Oceanic markets, emphasizing resilient textiles for seismic and cyclonic climes.

Bidim®/Secureline®: Nonwovens/wovens (100–800 g/m², $0.50–$2.50/m²), 15–80 kN/m tensile, 0.1–0.3 cm/s permeability. Metrics: 6 m rolls, 30% recyclates, 40-year durability in harsh environs. ISO 9001/AS certified.

Suited for quake-prone roadways, mining hauls, and coastal defenses. Merits: Tailored antipodal schemas, 90% quake resilience, and regional acuity. Drawbacks: Constrained non-Pacific reach; moderate capacities.

Global Synthetics’ 2024 Australian cyclone bulwark (25,000 m² Bidim®) quelled 80% littoral incursion, salvaging $200,000 in post-storm restorations.

3. Comparison Table of the Top 8 Global Geotextiles Manufacturer

| Manufacturer | Price ($/m²) | Weight (g/m²) | Tensile Strength (kN/m) | Permeability (cm/s) | Key Certifications | Key Applications |

| BPM Geosynthetics | 0.30–3.00 | 100–800 | 8–120 | 0.05–0.4 | ISO 9001, ASTM, CE | Roads, Erosion Control, Landfills |

| GEOSINCERE | 0.40–2.00 | 100–1,000 | 10–80 | 0.1–0.3 | ISO 9001, CE | Railways, Mining, Slopes |

| Solmax International | 0.50–3.00 | 100–1,200 | 10–200 | 0.05–0.4 | GRI, ISO 9001 | Pavements, Riverbanks |

| TenCate Geosynthetics | 0.60–2.80 | 140–1,100 | Up to 25 | 0.1 | ASTM, AASHTO | Coastal, Agriculture |

| HUESKER International | 0.70–2.50 | 100–1,000 | 20–100 | 0.05–0.3 | ISO 9001, CE | Retaining Walls, Hydraulics |

| Low & Bonar | 0.50–2.20 | 150–800 | 15–65 | 0.2 | ISO 14001 | Farming, Civil Works |

| Hanes Geo Components | 0.40–2.00 | 100–600 | 10–50 | 0.1–0.4 | ASTM | Stormwater, Walls |

| Global Synthetics | 0.50–2.50 | 100–800 | 15–80 | 0.1–0.3 | ISO 9001, AS | Seismic Roads, Coastal Defenses |

This synopsis enables expeditious juxtaposing, spotlighting pivotal variances for bespoke exigencies.

4. Why Choose Geotextiles?

Geotextiles eclipse archaic expedients like ballast mantles or concrete facings, attaining 95% particulate demarcation at 20–30% fiscal thrift. Deployment hastens by 40–50% through unspooling and lapping, with negligible locus perturbation. Their pliancy to differential subsidence diminishes collapse incidences by 60% in yielding terrains, whilst fiscal audits evince $3–5/m² husbandry across 20 years via scour preclusion. Ecologically, they abate quarrying (1 ton/m³ conserved) and facilitate vegetated ameliorations, harmonizing with ESG edicts for verdant evolution.

5. Key Applications of Geotextiles

Geotextiles’ polymorphism traverses pivotal dominions, proffering precision-engineered panaceas for manifold quandaries.

5.1 Road Construction and Pavement Repair

Dominating 53% of utilization, wovens in roadways apportion burdens, forestalling rutting (30% amelioration). Nonwovens sieve particulates in bases, prolonging overlays by 20–40%. Solmax and BPM predominate with lofty-tenacity conformants to AASHTO M288.

5.2 Erosion Control and Coastal Protection

Nonwovens stabilize escarpments and littorals, retaining 90% detritus whilst venting 0.2 cm/s. GEOSINCERE’s filament iterations radiate in kinetic milieus, diminishing abrasion by 50–70% in bulwarks.

5.3 Reinforcement and Soil Stabilization

Lofty-modulus wovens à la HUESKER’s Fortrac® interlace aggregates, elevating CBR by 50% in frail loams for ramparts. Seismic precincts profit from 1.5–2.0 safety quotients.

5.4 Drainage and Filtration Systems

Acupunctured nonwovens (e.g., TenCate Mirafi®) encase Gallic conduits, securing 95% anti-obstruction (O90 <0.2 mm). In refuse mounds, they direct percolate, conforming to EPA Subtitle D and slashing taint perils by 98%.

5.5 Railway and Agriculture Uses

Beneath rails, geotextiles minimize ballast fouling, curtailing tamping by 25%. In tillage, Low & Bonar’s osmotic strata husband moisture (30% boost) whilst quelling intruders, per agrarian assays.

6. Case Studies

6.1 Malaysian Highway Reinforcement (BPM Geosynthetics)

BPM’s 250 g/m² nonwoven shored 50 km subgrade, hiking CBR by 35% and thrift $120,000 in fillers. Post-2024 squalls, nil subsidences transpired, affirming 90% firmness accruals.

6.2 Brazilian Railway Subgrade (GEOSINCERE)

30,000 m² of 350 g/m² filament fabric quelled variance subsidence by 25%, sanctioning 120 km/h velocities. The venture, under fiscal, protracted track span by 15 years, per transit metrics.

6.3 Florida Coastal Dune Restoration (TenCate Geosynthetics)

TenCate’s Mirafi® fortified 40,000 m² contra hurricanes, staunching 70% erosion and reinstating habitats. 2024 surveillance evinced 95% verdure triumph, yielding $150,000 in annual littoral aegis.

6.4 German Highway Upgrade (HUESKER International)

HUESKER’s HaTe® in 50,000 m² ameliorated burden diffusion by 40%, extending longevity by 20 years and paring mends by €100,000/year, per autobahn dossiers.

6.5 European Power Grid Recycling Initiative (Solmax International)

Solmax, with TenneT and SWITCH, repurposed 80 tons (500,000 m²) geotextiles from a 2024 power thoroughfare, diverting refuse from tumuli and reinfusing circular paradigms, economizing €500,000 in disposals whilst curbing emissions by 15%.

7. Conclusion

The top 8 global geotextiles manufacturers—BPM Geosynthetics, GEOSINCERE, Solmax, TenCate, HUESKER, Low & Bonar, Hanes Geo, and Global Synthetics—epitomize supremacy in ingenuity, steadfastness, and fiscal acumen for 2025’s infrastructural imperatives. Spanning $0.30–$3.00/m² with tensile potencies of 8–200 kN/m and accreditations like ASTM D4595, these purveyors assure endurances contra elemental rigors whilst paring outlays by 15–30%. For fiscal magnitude, BPM prevails; for verdant sieving, GEOSINCERE guides. Heed permeability (0.05–0.4 cm/s) and utilitarian mandates to maximize yields. Alliances with these forges not solely bulwark your constructs but propel tenable engineering—initiate dialogues for exemplars and tenders to galvanize your forthcoming pursuit.