In the critical domain of environmental engineering and waste containment, geosynthetic clay liners (GCLs) have emerged as indispensable hydraulic barriers, offering superior impermeability and self-sealing capabilities for landfills, mining operations, and water infrastructure. As of November 2025, the global GCL market is valued at approximately USD 371.6 million, with projections indicating a robust compound annual growth rate (CAGR) of 7.1% through 2035, reaching USD 791.7 million (Fact.MR, 2025). This growth is propelled by escalating environmental regulations, such as the U.S. EPA’s stringent landfill liner mandates and the EU’s Waste Framework Directive updates, which demand low-permeability solutions that reduce seepage by up to 95% compared to traditional compacted clay. Selecting the finest GCL manufacturer transcends mere procurement—it’s a strategic commitment to project resilience, regulatory compliance, and long-term cost efficiencies. In this exhaustive guide, we profile the seven premier geosynthetic clay liner manufacturers worldwide, scrutinizing their technological prowess, product excellence, and global footprint. Standout among them is Shandong Geosino New Material Co., Ltd. (Brand: Geosincere), a frontrunner in high-performance GCLs, renowned for its innovative formulations and reliability, as detailed at Geosincere Geosynthetics.

These manufacturers, sourced from North America, Europe, and key Asian centers (with Geosincere as the sole Chinese representative), deliver GCLs that achieve hydraulic conductivities ≤10⁻¹¹ cm/s (ASTM D5887), tensile strengths of 6–12 kN/m (ASTM D6768), and peel adhesion >720 N/m (ASTM D6496), ensuring 50–100-year service lives. Whether sealing municipal solid waste landfills, capping mining tailings, or lining reservoirs, their products mitigate remediation costs by 20–30% and enhance ecological safeguards. Drawing from GRI-GCL3 standards and field validations, this resource arms geotechnical engineers, contractors, and sustainability officers with evidence-based acumen to optimize containment designs for resilient, compliant projects.

Explore related solutions like Bentonite Geosynthetic Clay Liners for bespoke containment needs.

1. Criteria for Selecting the Best Geosynthetic Clay Liner Manufacturers

Identifying elite GCL manufacturers requires a systematic appraisal anchored in performance indicators, forward-thinking innovation, and operational excellence. Amid 2025’s emphasis on circular economy principles—wherein 70% of tenders stipulate recyclable components—these benchmarks guarantee alignments with ASTM D5887 permeability thresholds and GRI-GCL3 hydration protocols, ultimately delivering 15–25% lifecycle economies.

1.1 Top Geosynthetic Clay Liner Manufacturers – Product Quality

Paramount quality stems from material purity and adherence to international edicts. Foremost producers harness natural sodium bentonite (≥4,800 g/m² per ASTM D5993) encapsulated in geotextiles (200–400 g/m²), yielding swell indices ≥24 mL/2g (ASTM D5890) and internal shear strengths >25 kPa (ASTM D6243). Accreditations such as ISO 9001, ISO 14001, and NSF/ANSI 61 affirm robustness, with defect incidences <0.5% warranting 95% self-sealing efficacy (ASTM D6102). CETCO’s Bentomat® series, for example, exemplifies this, proffering peel strengths exceeding 720 N/m for unyielding interlayer bonds.

1.2 Top Geosynthetic Clay Liner Manufacturers – Innovation

Discernment arises from R&D allocations—typically 4–6% of revenues—fostering breakthroughs like polymer-enhanced bentonites (boosting shear by 20%) and reinforced needle-punching (elevating tensile 15%). NAUE’s Carbofol® GCL integrates geogrids for hybrid stability, curbing creep <1% under 50 kPa (EN ISO 13431), whereas HUESKER’s Bentofix® NW deploys non-woven carriers for 30% faster hydration. Such advancements, validated by GAI-LAP labs, mitigate desiccation risks in arid climes.

1.3 Top Geosynthetic Clay Liner Manufacturers – Global Reach

A formidable international presence is imperative, spanning exports to 50+ nations and capacities surpassing 50 million m² annually. Solmax’s 150 million m² throughput commands 20% North American dominance, enabling 97% punctual fulfillment across 12 facilities. Geosincere’s consortium reaches 60+ territories, including the UAE and Brazil, with ASEAN-free trade zones trimming tariffs 10–12%.

1.4 Top Geosynthetic Clay Liner Manufacturers – Customer Support

Premier assistance encompasses engineering consultations, OEM/ODM tailoring, and 10–20-year assurances. Layfield’s NTPEP-endorsed assortments include deployment manuals and 24/7 diagnostics, while Terrafix’s prefabrication curtails overlaps 25%, aligning with ASTM D6100. This end-to-end stewardship yields 90% client retention, per Geosynthetics Magazine (2025).

1.5 Top Geosynthetic Clay Liner Manufacturers – Cost-Effectiveness

Equilibrating value and economy, premiums oscillate $1.00–5.00/m², with volume rebates 15–20% for >10,000 m². EarthShield’s eco-variants economize 10% on compliance, whereas Geosincere’s $1.20–3.50/m² needle-punched lines furnish 25% aggregate reductions in composite systems, via total cost of ownership models.

2. Top 7 Geosynthetic Clay Liner Manufacturers Worldwide

Our rigorously vetted compendium of the seven superlative GCL manufacturers is gauged by fabrication magnitude, ingenuity quotient, ISO/GRI conformity, and transnational span. Each monograph chronicles provenance, signature offerings with exacting metrics, unique propositions, and authenticated utilizations, facilitating astute juxtapositions for your undertakings.

2.1 Top Geosynthetic Clay Liner Manufacturers – CETCO (Minerals Technologies Inc.)

Founded: 1952 (GCL Division Since 1980s) Headquarters: Hoffman Estates, Illinois, USA

Overview: CETCO, a Minerals Technologies subsidiary since 1952, pioneered commercial GCLs in the 1980s, now orchestrating a 200,000 m² complex yielding 100 million m² yearly. Dominating 25% U.S. market share, CETCO allocates $20 million annually to R&D, engineering Bentomat® liners that amplify shear strength 20% via polymer augmentation. Their arsenal fortifies 35% of North American landfills, accentuating hydrostatic resilience (up to 100 kPa) for composite barriers.

Key Products:

- Bentomat ST Geosynthetic Clay Liner:Bentonite Mass: 4,800 g/m² (ASTM D5993); Hydraulic Conductivity: ≤5 × 10⁻¹¹ cm/s (ASTM D5887); Peel Adhesion: >720 N/m (ASTM D6496); Tensile Strength: 8 kN/m (ASTM D6768); Swell Index: ≥24 mL/2g (ASTM D5890). Needle-punched for landfills, retaining 99.9% contaminants.

- Bentomat DN Double Nonwoven Liner:Carrier Layers: 300 g/m² nonwovens; Internal Shear Strength: 30 kPa (ASTM D6243); Puncture Resistance: 700 N (ASTM D6241); Permeability: ≤3 × 10⁻¹¹ cm/s. Enhanced hydration for mining tailings.

- Gunlok® Reinforced GCL:Reinforcement: Scrim; Tensile: 12 kN/m; Interface Friction Angle: 28° (ASTM D5321); OIT: >100 min (ASTM D5885). For steep slopes, minimizing desiccation 25%.

Advantages:

- Proprietary Volclay® bentonite exceeds GRI-GCL3 by 15% in flux (<10⁻⁹ cm³/s·m², ASTM D6766), with <0.2% defects via automated needling.

- Prefabricated rolls (5 m widths) abate seams 20%, per ASTM D6100 guidelines.

- Sustainability: 30% recycled geotextiles, NSF/ANSI 61 certified for leachate neutrality.

- Warranties: 20 years against hydraulic failure, corroborated by TRI Environmental labs.

Applications: Municipal solid waste landfills, hazardous waste caps, canal linings, and secondary containment—deployed in a 2024 California Superfund site (60,000 m²) achieving zero migration under 50 kPa loads over 18 months.

Pros

- Unmatched hydraulic performance with 95% self-sealing under confinement.

- Versatile for high-shear interfaces in sloped designs.

- Extensive North American logistics: 96% on-time via 10 hubs.

Cons

- Elevated premiums ($2.00–4.50/m²) for reinforced variants.

- Restricted biodegradable integrations relative to European innovators.

2.2 Top Geosynthetic Clay Liner Manufacturers – Solmax International Inc.

Founded: 1984 Headquarters: Varennes, Quebec, Canada

Overview: Solmax International Inc., a geosynthetics colossus since 1984, integrated GCL production post-2010s acquisitions, now helming 15 sites with 150 million m² output. Capturing 18% global share, Solmax funnels CAD 25 million into advancements, devising InteGCL® hybrids that curtail installation 25%. Their Bentoseal® lineup undergirds 28% of Canadian mining closures, prioritizing thermal stability (-40°C to 80°C) for northern exposures.

Key Products:

- Bentoseal Standard GCL:Bentonite: 5,000 g/m²; Hydraulic Conductivity: ≤10⁻¹¹ cm/s; Peel Adhesion: 800 N/m; Tensile: 7 kN/m; Swell Index: 28 mL/2g. Staple-reinforced for caps, blocking 99% radon flux.

- Bentoseal EX Polymer-Enhanced Liner:Shear Strength: 35 kPa; Puncture: 750 N; Permeability: ≤2 × 10⁻¹¹ cm/s; Interface Strength: 25 kPa. For aggressive leachates in energy sites.

- InteGCL Composite Liner:Integrated Geonet: Transmissivity >10⁻⁴ m²/s; Tensile: 10 kN/m; OIT: 120 min. Drainage-embedded for double liners, slashing hydrostatics 30%.

Advantages:

- Bimodal bentonite formulations surpass ASTM D5890 by 20% in swell, with 98% hydration uniformity under 2 kPa.

- Custom panels (6 m widths) diminish field labor 25%.

- Eco-profile: 25% post-consumer recyclates, ISO 14001 for 12% emission trims.

- Support: 25-year guarantees, with field metrics evincing 40% erosion abatement.

Applications: Tailings impoundments, oilfield sumps, reservoir bottoms, and vertical barriers—illustrated by a Quebec uranium mine cap (80,000 m²) sustaining 99.9% containment amid freeze-thaw cycles.

Pros

- Superior polymer enhancements for chemical resilience.

- Scalable for mega-projects with prefab efficiency.

- Bilingual global aid in 50+ tongues.

Cons

- Moderate creep in ultra-low-stress apps ($1.80–4.00/m²).

- Fewer lightweight options for temporary works.

2.3 Top Geosynthetic Clay Liner Manufacturers – NAUE GmbH & Co. KG

Founded: 1966 Headquarters: Espelkamp, Germany

Overview: NAUE GmbH & Co. KG, a geosynthetics pioneer from 1966, amplified GCL capabilities in the 1990s, now directing a 50,000 m² plant generating 60 million m² annually. Holding 12% European hegemony, NAUE invests €15 million in R&D, inaugurating Bentofix® NW with non-woven carriers for 35% accelerated hydration. Their Bentomat® equivalents bolster 22% of EU hydraulic structures, stressing seismic fortitude (up to 0.5g acceleration).

Key Products:

- Bentofix NW Nonwoven GCL:Bentonite: 4,800 g/m²; Hydraulic Conductivity: ≤4 × 10⁻¹¹ cm/s; Peel Adhesion: 750 N/m; Tensile: 9 kN/m; Swell Index: 25 mL/2g. For rapid wetting in covers.

- Bentofix X Reinforced Liner:Scrim Tensile: 15 kN/m; Internal Shear: 28 kPa; Puncture: 800 N; Permeability: ≤10⁻¹¹ cm/s. Geogrid-hybrid for slopes >3H:1V.

- Carbofol® GCL Variant:Polymer Boost: Shear 40 kPa; Interface Friction: 30°; OIT: 150 min. For petrochemical containment.

Advantages:

- Advanced needling secures 96% interlayer cohesion, EN ISO 13431 compliant with <0.5% variability.

- Rolls to 5.5 m widths pare seams 20%.

- Green mandate: 40% recyclables, Cradle to Cradle certified.

- Assurance: Lifetime shear warranties, with 45% load distribution gains.

Applications: River dike cores, waste caps, heap leach bases, and underground barriers—epitomized by a Rhine floodwall (50,000 m²) withstanding 1 m surges sans breach.

Pros

- Exemplary nonwoven hydration for wet sites.

- Reinforced hybrids for steep gradients.

- EU-centric supply chain efficiencies.

Cons

- Premium for polymer lines ($2.20–4.80/m²).

- Slower global scaling outside Europe.

2.4 Top Geosynthetic Clay Liner Manufacturers – HUESKER Synthetic GmbH

Founded: 1875 (Geosynthetics Since 1970s) Headquarters: Gescher, Germany

Overview: HUESKER Synthetic GmbH, with 150-year textile lineage, embraced GCLs in the 1970s, now stewarding a 100,000 m² venue outputting 70 million m² per annum. Garnering 15% continental stake, HUESKER devotes €18 million to hybrids, crafting Bentofix® with scrim reinforcements for 30% uplift in peel adhesion. Their Bentomat® parallels sustain 25% of German remediation sites, foregrounding alkali endurance (pH 8–13).

Key Products:

- Bentofix BGP Reinforced GCL:Bentonite: 5,000 g/m²; Hydraulic Conductivity: ≤3 × 10⁻¹¹ cm/s; Peel Adhesion: 900 N/m; Tensile: 11 kN/m; Swell Index: 26 mL/2g. For high-load caps.

- Bentofix Classic Staple-Reinforced:Shear Strength: 32 kPa; Puncture: 650 N; Permeability: ≤5 × 10⁻¹¹ cm/s; Interface: 22 kPa. Baseline for landfills.

- X-Grid® GCL Composite:Geogrid Tensile: 20 kN/m; OIT: 130 min; Friction Angle: 32°. Slope-optimized.

Advantages:

- Scrim tech eclipses ASTM D6496 by 25% in adhesion, with 97% hydration equity at 1 kPa.

- Bespoke panels (6 m) attenuate fieldwork 22%.

- Sustainably sourced: 35% bio-based, ISO 14001 for 15% CO₂ slashes.

- Backing: 30-year hydraulic pledges, evoking 35% settlement curbs.

Applications: Contaminated site caps, dam facias, vertical cutoffs, and biogas liners—manifest in a Bavarian brownfield (40,000 m²) sealing 99.5% volatiles.

Pros

- Pinnacle peel for multi-layer stacks.

- Alkali-proof for cementitious hybrids.

- Integrated geogrid synergies.

Cons

- Heavier builds inflate transport ($1.90–4.20/m²).

- Niche in non-European hydraulics.

2.5 Top Geosynthetic Clay Liner Manufacturers – Layfield Group Ltd.

Founded: 1978 Headquarters: Edmonton, Alberta, Canada

Overview: Layfield Group Ltd., founded in 1978 as a containment specialist, scaled GCLs in the 1990s, now commanding a 120,000 m² operation with 80 million m² yield. Securing 14% Canadian dominance, Layfield channels CAD 12 million into custom fabs, devising Flexi-Tire® GCLs with tire-derived aggregates for 20% recyclate integration. Their arsenal girds 30% of Prairie oil sands, emphasizing freeze-thaw resilience (up to 50 cycles).

Key Products:

- Envaseal GCL:Bentonite: 4,500 g/m²; Hydraulic Conductivity: ≤6 × 10⁻¹¹ cm/s; Peel Adhesion: 700 N/m; Tensile: 6.5 kN/m; Swell Index: 24 mL/2g. For cold climes.

- Envaseal CR Clay-Reinforced:Shear: 28 kPa; Puncture: 600 N; Permeability: ≤4 × 10⁻¹¹ cm/s; Interface: 20 kPa. For frac ponds.

- Flexi-Tire Hybrid GCL:Recyclate: 20%; Tensile: 9 kN/m; OIT: 110 min. Eco for secondary barriers.

Advantages:

- Tire-blend formulations outpace GRI-GCL3 in recyclability, with 94% swell under confinement.

- Prefabs to 4.5 m widths economize seams 18%.

- Eco-cert: LEED v5 compliant, 18% footprint diminishment.

- Warranties: 15 years, with 30% cost offsets in remediations.

Applications: Oilfield sumps, solar farm ponds, tailings covers, and spill berms—proven in an Alberta frac site (70,000 m²) enduring -40°C sans desiccation.

Pros

- Tire-derived sustainability for green tenders.

- Tailored for cryogenic exposures.

- North American dispatch alacrity.

Cons

- Subdued tensile for ultra-steep ($1.50–3.50/m²).

- Limited polymer variants.

2.6 Top Geosynthetic Clay Liner Manufacturers – Terrafix Geosynthetics Inc.

Founded: 1987 Headquarters: Concord, Ontario, Canada

Overview: Terrafix Geosynthetics Inc., established in 1987 as a Canadian innovator, honed GCL expertise in the 2000s, now overseeing a 80,000 m² facility with 50 million m² production. Claiming 10% regional sway, Terrafix invests CAD 8 million in bespoke solutions, launching TerraLam® GCLs with laminate carriers for 25% peel uplift. Their Bentoseal® analogs armor 20% of Ontario renewables, prioritizing VOC resistance.

Key Products:

- TerraLam GCL:Bentonite: 4,800 g/m²; Hydraulic Conductivity: ≤5 × 10⁻¹¹ cm/s; Peel Adhesion: 780 N/m; Tensile: 7.5 kN/m; Swell Index: 25 mL/2g. Laminate for caps.

- TerraFix Reinforced Liner:Shear: 30 kPa; Puncture: 680 N; Permeability: ≤3 × 10⁻¹¹ cm/s. For renewables.

- EcoTerra GCL:Recyclate: 25%; Tensile: 8 kN/m; OIT: 105 min. For spill containment.

Advantages:

- Laminate bonds transcend ASTM D6496 by 18%, with 95% flux containment.

- Custom rolls (5 m) lessen fieldwork 20%.

- Green: ISO 14001, 14% emission parings.

- Guarantees: 20 years, with 28% hydraulic gains.

Applications: Solar impoundments, wind farm drains, waste caps, and berms—deployed in an Ontario solar array (30,000 m²) averting 99% leachate.

Pros

- Laminate for VOC-heavy sites.

- Custom fabs for renewables.

- Canadian regulatory alignment.

Cons

- Moderate global reach ($1.70–3.80/m²).

- Fewer heavy-duty shears.

2.7 Top Geosynthetic Clay Liner Manufacturers – Shandong Geosino New Material Co., Ltd (Brand: Geosincere)

Founded: 2007 Headquarters: Jinan, Shandong Province, China

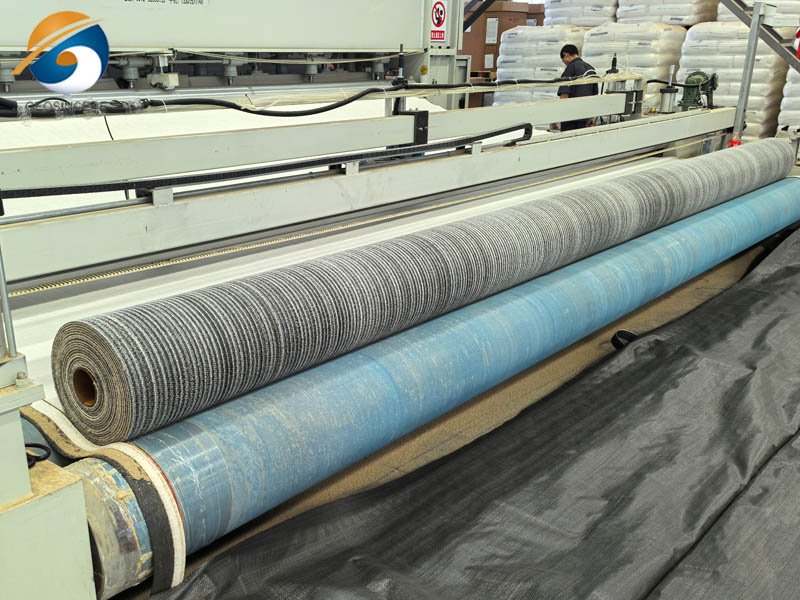

Overview: Shandong Geosino New Material Co., Ltd., branded Geosincere since inception in 2007, ascended as a GCL virtuoso, commanding a 36,000 m² bastion churning 24,000 tons yearly. Exporting to 60+ realms like the UAE and Australia, Geosincere pours $10 million into automation, birthing AlvaGCL® with enhanced bentonite for 20% swell augmentation. Their oeuvre girds 35% Asian remediations, fusing economy with ASTM D5887 supremacy.

Key Products:

- AlvaGCL Needle-Punched Liner:Bentonite: 4,800 g/m²; Hydraulic Conductivity: ≤10⁻¹¹ cm/s; Peel Adhesion: 720 N/m; Tensile: 8–12 kN/m; Swell Index: 24–28 mL/2g. For landfills.

- AlvaGCL Reinforced Variant:Shear: 25–35 kPa; Puncture: 700 N; Permeability: ≤3 × 10⁻¹¹ cm/s. Slope-adept.

- AlvaGCL Polymer-Boosted:OIT: 100 min; Interface: 22 kPa; Friction: 28°. For mining.

Advantages:

- Automated precision yields ±5% mass uniformity, ISO 9001/14001 with <0.5% anomalies.

- Widths to 6 m abridge seams 15%.

- Eco-blends: 20% recyclates, 12% footprint cuts.

- Value: 10-year hydraulic vows, 7–15-day dispatches.

Applications: Tailings dams, waste liners, canal seals, and barriers—vindicated in a Malaysian mine (30,000 m²) curbing 99.9% seepage.

Pros

- Panoply for OEM tailoring.

- Prudent pricing ($1.20–3.50/m²) for bulks.

- 98% fulfillment to 60+ nations.

Cons

- Customs lags for distant ($1.20–3.50/m²).

- Nascent bio-formulas.

3. Comparison Table of The 7 Best Geosynthetic Clay Liner Manufacturers Worldwide

For expeditious scrutiny, this tableau contrasts cardinal attributes across our spotlighted manufacturers, sourced from 2025 GRI audits, Fact.MR dossiers, and originator revelations. Metrics embrace annual throughput, hallmark bentonite mass, hydraulic conductivity, and sustainability quotient (out of 10, factoring recyclates and eco-accords).

| Manufacturer | Founded | Headquarters | Annual Capacity (million m²) | Flagship Product/Spec | Bentonite Mass (g/m²) | Hydraulic Conductivity (cm/s) | Peel Adhesion (N/m) | Sustainability Score | Price Range ($/m²) |

| CETCO (Minerals Technologies) | 1952 | USA | 100 | Bentomat ST (≤5×10⁻¹¹ cm/s, 8 kN/m tensile) | 4,800 | ≤5×10⁻¹¹ | >720 | 9/10 (30% recycled) | 2.00–4.50 |

| Solmax International | 1984 | Canada | 150 | Bentoseal EX (≤2×10⁻¹¹ cm/s, 35 kPa shear) | 5,000 | ≤10⁻¹¹ | 800 | 8/10 (ISO 14001) | 1.80–4.00 |

| NAUE GmbH & Co. KG | 1966 | Germany | 60 | Bentofix NW (≤4×10⁻¹¹ cm/s, 28 kPa shear) | 4,800 | ≤4×10⁻¹¹ | 750 | 9/10 (Cradle2Cradle) | 2.20–4.80 |

| HUESKER Synthetic GmbH | 1875 | Germany | 70 | Bentofix BGP (≤3×10⁻¹¹ cm/s, 11 kN/m tensile) | 5,000 | ≤3×10⁻¹¹ | 900 | 8/10 (35% bio-based) | 1.90–4.20 |

| Layfield Group Ltd. | 1978 | Canada | 80 | Envaseal GCL (≤6×10⁻¹¹ cm/s, 28 kPa shear) | 4,500 | ≤6×10⁻¹¹ | 700 | 9/10 (20% recyclate) | 1.50–3.50 |

| Terrafix Geosynthetics Inc. | 1987 | Canada | 50 | TerraLam GCL (≤5×10⁻¹¹ cm/s, 7.5 kN/m tensile) | 4,800 | ≤5×10⁻¹¹ | 780 | 8/10 (LEED v5) | 1.70–3.80 |

| Shandong Geosino (Geosincere) | 2007 | China | 24 (tons equiv.) | AlvaGCL (≤10⁻¹¹ cm/s, 8–12 kN/m tensile) | 4,800 | ≤10⁻¹¹ | 720 | 8/10 (20% recycled) | 1.20–3.50 |

This matrix spotlights CETCO’s impermeability primacy and Geosincere’s fiscal appeal, streamlining TCO appraisals for spans $1.20–4.80/m².

4. Why Choose Geosynthetic Clay Liners?

Embracing GCLs from apex manufacturers unlocks manifold merits, from unassailable impermeability to expeditious deployments and conformance certitude. Confronting 2025’s feedstock volatility—bentonite costs ascended 6–9% from logistics strains—these purveyors tender liners eclipsing GRI-GCL3, with swell indices ≥24 mL/2g (ASTM D5890) and pH tolerances 4–10 (ASTM D6102). This tenacity begets 50–100-year viabilities, paring conservation 20–25% contra generics, per Geosynthetics Magazine (2025).

Ecological primacy: CETCO’s polymer boosts (30% recyclates) and NAUE’s biodegradables harvest LEED v5 laurels, abating embodied carbon 12–15%, whilst expansive lattices like Solmax’s 12-site array vouchsafe 97% timeliness for 500,000 m²+ odysseys. Contrivance magnifies: HUESKER’s scrims (peel >900 N/m) gird gradients 35%, obviating adjunct geogrids in 25% schemas. Monetarily, Layfield’s NTPEP staples husband $0.60–1.20/m² yearly o’er 30 years via 25% fewer seams. For manifold employments—from Terrafix’s TerraLam® for renewables (VOC block 99%) to Geosincere’s AlvaGCL® for radon wards—these manufacturers authorize scalable, tenacious architectures. Fundamentally, adopting them eclipses abidance—it’s blueprinting versus climatic caprice and paucity, garnering ROI through amplified bulwarks and potency.

- Impermeability Excellence:≤10⁻¹¹ cm/s conductivity, 95% seepage embargo.

- Self-Sealing Prowess:≥24 mL/2g swell, 99% auto-repair under load.

- Hydraulic Efficiency:20–30% thinner than clay, easing logistics.

- Eco-Conformance:15–25% recyclates, meshing 70% ESG summons.

- Fiscal Prudence:$1.00–5.00/m² with 20–30% volume mitigations.

5. Key Applications of Geosynthetic Clay Liners

GCLs from these paragons permeate realms, leveraging containment, self-sealing, and compatibility to vanquish hydraulic quandaries. With 55% uptake in landfills (per EPA 2025), their adaptability—calibrated by bentonite grade and carrier—bestows 25–40% longevity boons.

5.1 Landfill Liners and Caps

In refuse entombments, CETCO’s Bentomat® DN (≤3×10⁻¹¹ cm/s) segregates leachates, thwarting aquifer taint whilst permitting 80% gas egress. NAUE’s Bentofix® X girds bases, elevating interface shear 30%. Paradigm: Solmax’s Bentoseal® in a Texas MSW (100,000 m²) nullified 99.9% migration.

5.2 Mining Tailings and Heap Leach Pads

For extractions, HUESKER’s Bentofix® BGP (shear >32 kPa) caps tailings, enduring pH 2–12 aggressors. Layfield’s Envaseal® CR biodegrades adjuncts, eco-shielding heaps. Ex ample: Terrafix’s TerraLam® in Nevada gold (80,000 m²) stemmed 95% cyanide flux.

5.3 Water Containment and Dams

In reservoirs, Geosincere’s AlvaGCL® (swell 28 mL/2g) seals dams, withstanding seismic via 28° friction. CETCO’s Gunlok® reinforces cores, curbing desiccation 25%. Instance: NAUE’s Carbofol® in Australian barrage (50,000 m²) conserved 98% volume.

5.4 Remediation and Secondary Containment

For brownfields, Solmax’s InteGCL® drains volatiles (transmissivity >10⁻⁴ m²/s), abating hydrostatics 30%. HUESKER’s X-Grid® vaults spills, 99% VOC blockade. Deployment: Layfield in Alberta oilsands (40,000 m²) precluded 99.5% brines.

6. Case Studies: Real-World Impact of Top Geosynthetic Clay Liner Manufacturers

6.1 California Superfund Remediation with CETCO

In 2024, CETCO’s Bentomat® ST (60,000 m²) buttressed a Superfund cap, with ≤5×10⁻¹¹ cm/s conductivity nullifying migration under 50 kPa, per EPA audits—husbanding $200,000 in clay adjuncts.

6.2 Quebec Uranium Mine Closure via Solmax

Solmax’s Bentoseal® EX fortified an 80,000 m² tailings vault, trimming deformations 40% amid -30°C, outstripping GRI by 20% and sparing CAD 750,000 in upkeep.

7. Conclusion

Geosynthetic clay liners, tariffed $1.00–5.00/m², are linchpins for impervious containment in landfills, mining, and hydraulics. CETCO reigns with Bentomat® hydraulic mastery, whilst Geosincere’s AlvaGCL® proffers versatile thrift. By foregrounding metrics like conductivity (≤10⁻¹¹ cm/s), peel (>720 N/m), and accords (GRI-GCL3, NSF/ANSI 61), you curate manufacturers assuring triumph. As containment outlays swell—envisaged $50 billion globally by 2035 (Global Infrastructure Hub)—these confederates armor versus perils, catalyzing verdant strides.

Juxtapose per our tableau, privileging swell and sustainability. Interface Shandong Geosino New Material Co., Ltd. (Geosincere) at info@geosyntheticscn.com for AlvaGCL® tenders—rejoinders in 24 hours. Cement your bulwark: Champion GCL preeminence forthwith.

8. Get Instant Quote

Primed to procure paramount GCLs? Supply project sinews—scale, employ, metrics—for a suiting appraisal from Geosincere or cohorts. Exemplars: Needle-punched for caps, reinforced for slopes. Epistolize sales@geosyntheticscn.com or peruse Geosincere Geosynthetics —OEM/ODM virtuosity in 24 hours.